Know Your Bank (4)

The Banking system in India is invoking KYC (Know Your Customer) details from every one of its customers. But, how much we know about our Banks?

Since 2007, we have been invoking information through RTI (Right To Information) Act from various PSU Banks, Reserve Bank of India, Central Vigilance Commission (CVC) and Ministry of Finance. The information are related to Banking operations (Savings/Current Account Maintenance), Lending (Sanctioning & Pricing) and Ethics (non-discriminatory Recovery principles) which are in place.

The pictorial /cartoon depictions published in this website are based on facts revealed under RTI.

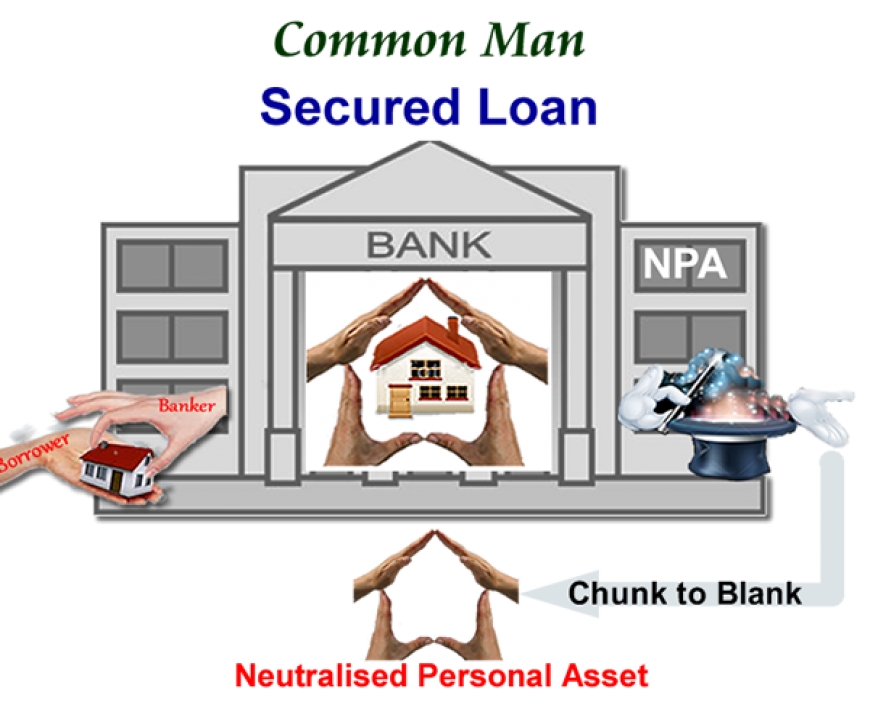

Discriminatory Loan Default Recovery Procedures :

Magician : Banks

Magic Wand - SARFAESI Act. 2002

Banks (Cats) will become Tigers and plunder the Secured Small Borrowers.

With Corporate Borrowers the Banks (Cats) prefer to be feel sleepy ......

Handshake - Hand full - Hand in Glove relationship.

Finance Minister: Businessline : 25.10.2012

Reserve Bank of India :

Sanctioning of Loans

"If a Dog jumps into your lap, it is because it is fond of you; but if a Cat does the samething, it is because your lap is warm" - A.H. Whilehead.

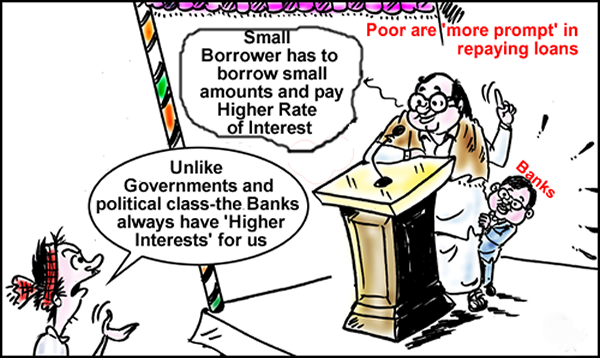

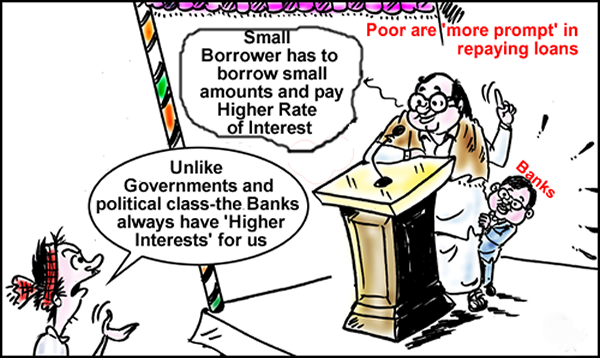

Small Borrowers must have to be "wealthy" enough for exploitations.

Deficit in diligent Pricing of loans

Deficit in diligent Pricing of loans

"You own a Dog but you feed a Cat" - Jenny de Vires

"Dog eats; Cats dine" - Ann Taylor

Of late, the Governments are claiming that the Economy is based on Market Prices which were determined through demand and supply. The commodity of the Banks is money. If so, why there is no differential pricing in the lending rates of various banks. The Banks in India function as a cartel.

Small Borrowers are meant to be "Buffers".

Lending Interest rates are not based on "Cost Analysis", but based on "Necessities of the Bank to show profits.

Competition Commission of India :

The Competition Commission of India is investigating the Banks cartelization issue suo motto because no one dared to file a complaint against the Banking Cartel. We have filed a petition against the Banks and the Reserve Bank of India for imposing restrictions in ATM usage in the CCI.

We the public are supporting the Banks......

Finance Minister: Businessline : 25.10.2012

Reserve Bank of India :

In a Cat's eye all things belong to Cats" - Eng Proverb

Whenever a Customer of a Bank looses his money from his Current/Savings Account due to Cyber frauds/ATM frauds. The frauds are immediately declared as "Phishing Frauds". It means, the Customer lost his money due to his carelessness and failing to keep the secrecy of the Password of his Account. The Banks will not embark upon the evidences within their system to apprehend the culprits or investigate for any insiders participation; because, they believe the money lost was theirs and not yours.

Whenever a Customer of a Bank looses his money from his Current/Savings Account due to Cyber frauds/ATM frauds. The frauds are immediately declared as "Phishing Frauds". It means, the Customer lost his money due to his carelessness and failing to keep the secrecy of the Password of his Account. The Banks will not embark upon the evidences within their system to apprehend the culprits or investigate for any insiders participation; because, they believe the money lost was theirs and not yours.

Yester Years :

Cash & Cheque - Money transactions are executed within the premises of the branch of the Bank. The Banks extend services with a half opened door, security personnel and CC TV surveillance as such multiple chain of evidences are instantaneously developed.

Thereby, any Security breaches will be tracked easily and accountable. The Banking Administrations will have to behave with utmost responsibility and are easily made accountable. As such the Security of our Bank Accounts are ensured.

A fraudster has to take lot of efforts till the last mile to rob a Bank......

Modern Days Net Banking & ATM Transactions:

Economy defines Money as "liquid".

Electronics e-vapourates the Money for Net Banking.

Evidences are "cloudy".

RBI & the Banks ensure that the fraudsters are at "cloud-9".

Fraudsters, RBI & the Banks tend to hide behind the "Cloud"- Banking privacy (piracy) laws. RTI had recorded the evidence for this.

In the past 5 years, it was estimated that more than Rs.27,000 Crores had been fraudulently withdrawn from various bank accounts of the Customers.

This will be not possible without the collusion of the insiders with the culprits.

The Banking Administrations and the Reserve Bank of India have consistently let down the Customers to suffer.

Deny Convenience and Security yet, deprive the Customer

Cat can workout mathematically, the exact place to sit that will cause most inconvenience (to others) -Pam Brown

The Banks like Cats know how to deny you the convenience and security and yet can charge for such deficient services. We are made to stand in the queue for depositing our cash in the CDM (Cash Deposit Machine) outside the Bank premises and also been charged.

c

c