Before 18th of October 1994: In India, the Public Funds within the Banking System were utilized through the discretionary directions of the RBI in consultation with the Government of India.

The Lending Interest rates were not based on individuals but on sector-wise utilization (SME, Agriculture ..........) The sector-wise lending Interest rates were decided by the Government of India by taking into account the nature of support necessitated for a specific sector to achieve an all around Social and Industrial developments.

The Social and Industrial developments were evidently slow may be because of the delay in systemic interventions or pro-active policy responses of the Government of the day or due to some flaws/blocks in the delivery system. But, the developments were orderly may be compared to - "twines of public money being utilized with prudence and discipline to have the end product of a woven fabric".

After 18th of October 1994:

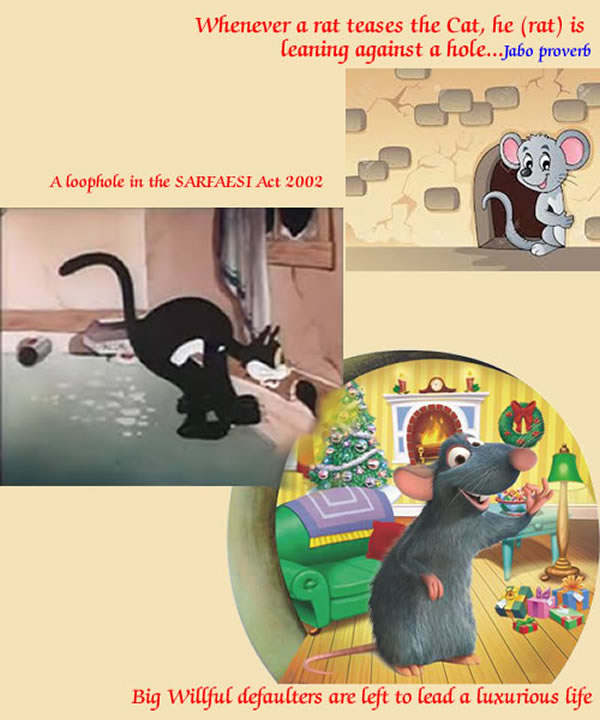

The political structure confessed its incompetence and left the Public Financial Resources to the discretionary management of banks. In the garb of Reforms and Market Economy "Cat Culture" was inherited into the system.

The Banks handled the Public Funds in their access like a Cat handling balls of twines.

Inflation and Banks:

There is a saying - "don't troop blindly to the roof like a Cat"

The Banks with lots of money at their disposal behave like cats without caring about repercussions. Blind and mindless lending policies are grabbed by the notorious elements. These elements manipulate the markets. That is why the Governments of the day are not able to address any issues related to inflation.

Bank's "Cat Culture" - led to acrimonious acrobatics.

We are entertained with visible unfettered developments without realizing that its cost and implications will be transferred over us by the Bank and the Government.

Impact - 1

Economy in tangles

The prevalence of "Cat culture" held us in a mesmerised world of fantasy.

The prevalence of "Cat culture" held us in a mesmerised world of fantasy.

We enjoyed the acrobatic antics of the Banks and the Government. The Banks and Governments are working without any Accountability. Both of them are enabled to transfer the cost escalations due to their inefficacies, corrupt practices and other losses over the larger public through dubious economic policies of "Market Economy".

Cost of Bank Loans:

We, the larger public more than satisfied to have access to the public funds as loans. But, we failed to recognise/evaluate the cost of such an access as loans.

Pretention at its best

No sooner, the Cats (Banks) will be released from the tangle of their(Banks) own making by the Government of the day.

The Cats (Banks) will be given a fresh lease of life through the balls of twines (flow of Public Funds) and the Cats (Banks) are going to repeat the antics.

Impact - 2

The Banks dare to take risks

Banks like Cats, are miserable in their calculations.....

Unsecured Lending of the Banks are based on futuristic calculations which goes awry for various reasons. The Banks being cushioned to transfer such unsecured lending losses over the other Small Secured Borrowers within their system through higher Interest charges. As such the banks like Cats dare to take risks.

Impact - 3

Banks as "floppy cats" :

The Cats render a great service to the humanity in the containment of "rat menace".

But, the Cat cultured Banks failed to perform this habitual duty as the Cats do.

Impact - 4

Cat is set among the Pigeons by the Government of India and RBI :

The Small Borrowers, who have pledged their securities are treated as pigeons by the Banks in India.

The Banks are at their predatory best against these Pigeons.

Impact - 5

The Banks like Cats can tune themselves to deafness ........

Millions of Farmers suicides, devastation of SSI Units and cries of ordinary Secured Borrowers have gone into deaf ears for the past two decades.